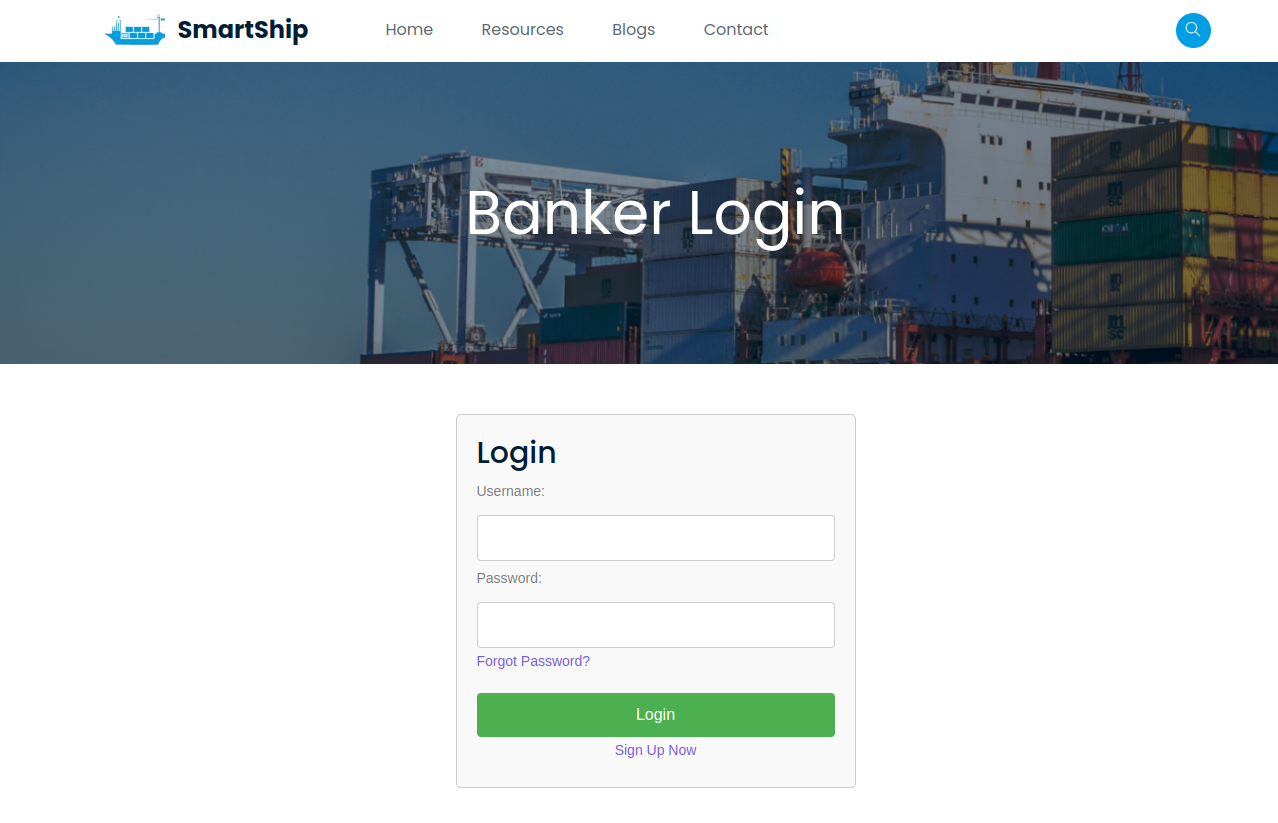

Login To The Banker Account

Using your registered username and password, login to the Banker account

Banks serve as financial institutions that provide a range of services, including savings and lending, facilitating transactions, and managing investments. They play a central role in the economy by channeling funds between savers and borrowers while offering essential financial products and services to individuals, businesses, and governments.

Banks play a pivotal role in facilitating international trade through letters of credit (LCs). In this context, banks act as intermediaries, providing a guarantee of payment to the seller (exporter) upon presentation of specified documents confirming that the terms of the sale have been met. This mechanism mitigates risks for both the buyer (importer) and the seller, ensuring that funds are only released when the conditions of the transaction are fulfilled. Banks scrutinize documents meticulously to ensure compliance with the LC terms, thereby safeguarding the interests of all parties involved in the trade transaction.

Using your registered username and password, login to the Banker account

After thorough scrutiny of the booking confirmation, the banker ensures that all details align with the established criteria. By cross-referencing the booking creation time and validating the booking data, any discrepancies are swiftly identified and resolved. This meticulous process instills confidence in the shipment's integrity, allowing the banker to proceed with the necessary payment procedures promptly and efficiently.

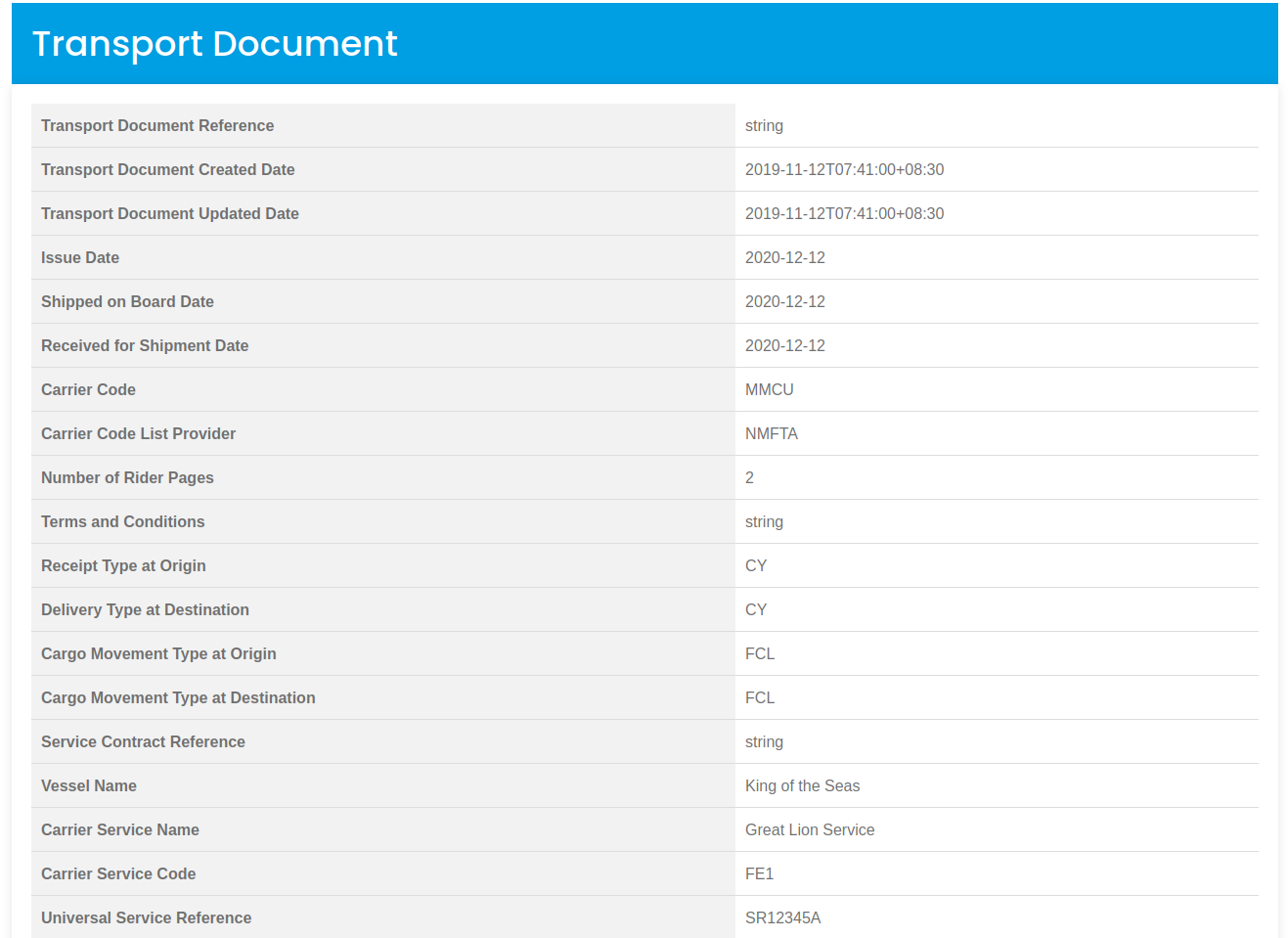

Indeed, verifying transport documents is a crucial step for a banker issuing a letter of credit. The transport document, often a bill of lading, serves as evidence that the goods have been shipped. This verification process ensures that the terms of the letter of credit are met before payment is made, providing security for both the buyer and the seller in the transaction.

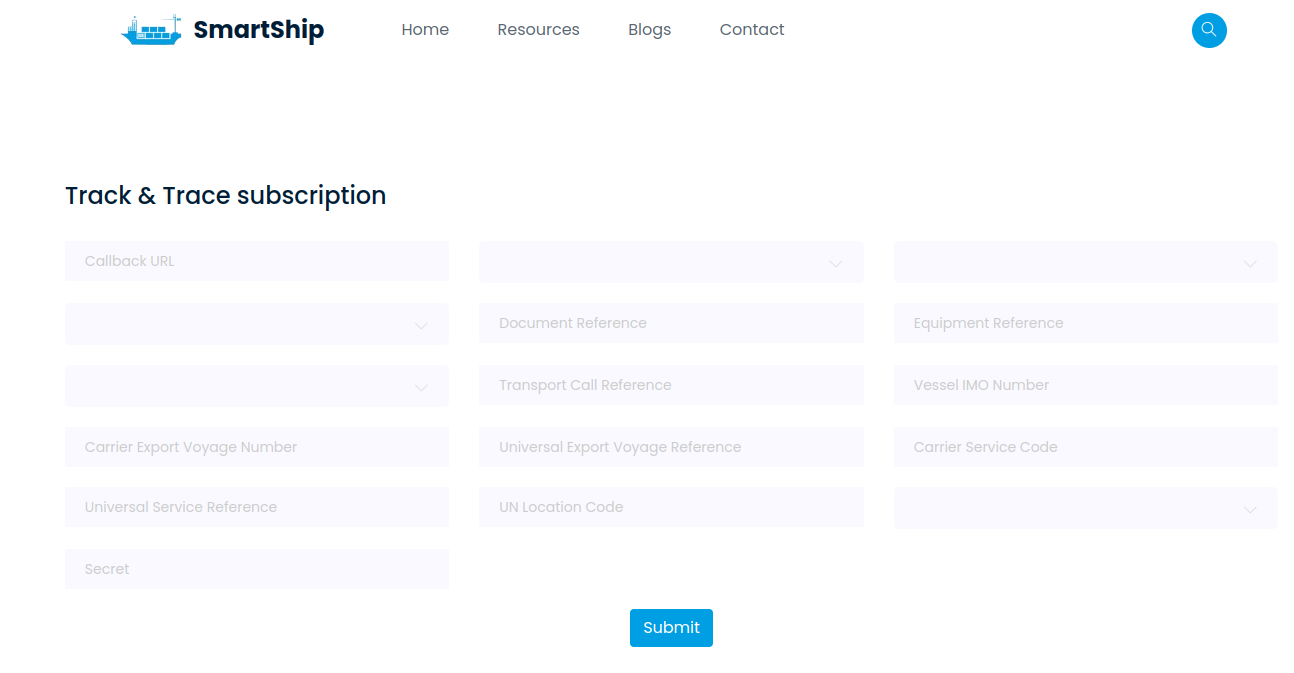

The shipper submits a track & trace subscription request to the carrier, seeking updates regarding the shipment, equipment, and transport events. This request enables the shipper to stay informed about the status and progress of the consignment throughout its journey.