Login To The Insurer Account

Using your registered username and password, login to the Insurer account

An insurer is a company or entity that provides insurance coverage to individuals, businesses, or other entities in exchange for the payment of premiums. Insurers assess risks and offer financial protection against potential losses or damages arising from specified perils, such as accidents, illnesses, property damage, or liability claims.

Insurers are entities that issue insurance policies to individuals or organizations, providing financial protection against specified risks in exchange for premiums. When issuing a policy, insurers assess the risk profile of the insured party and determine coverage terms and premiums accordingly. These policies outline the terms and conditions of the insurance agreement, including coverage limits, exclusions, and claim procedures, ensuring clarity and mutual understanding between the insurer and the insured.

Using your registered username and password, login to the Insurer account

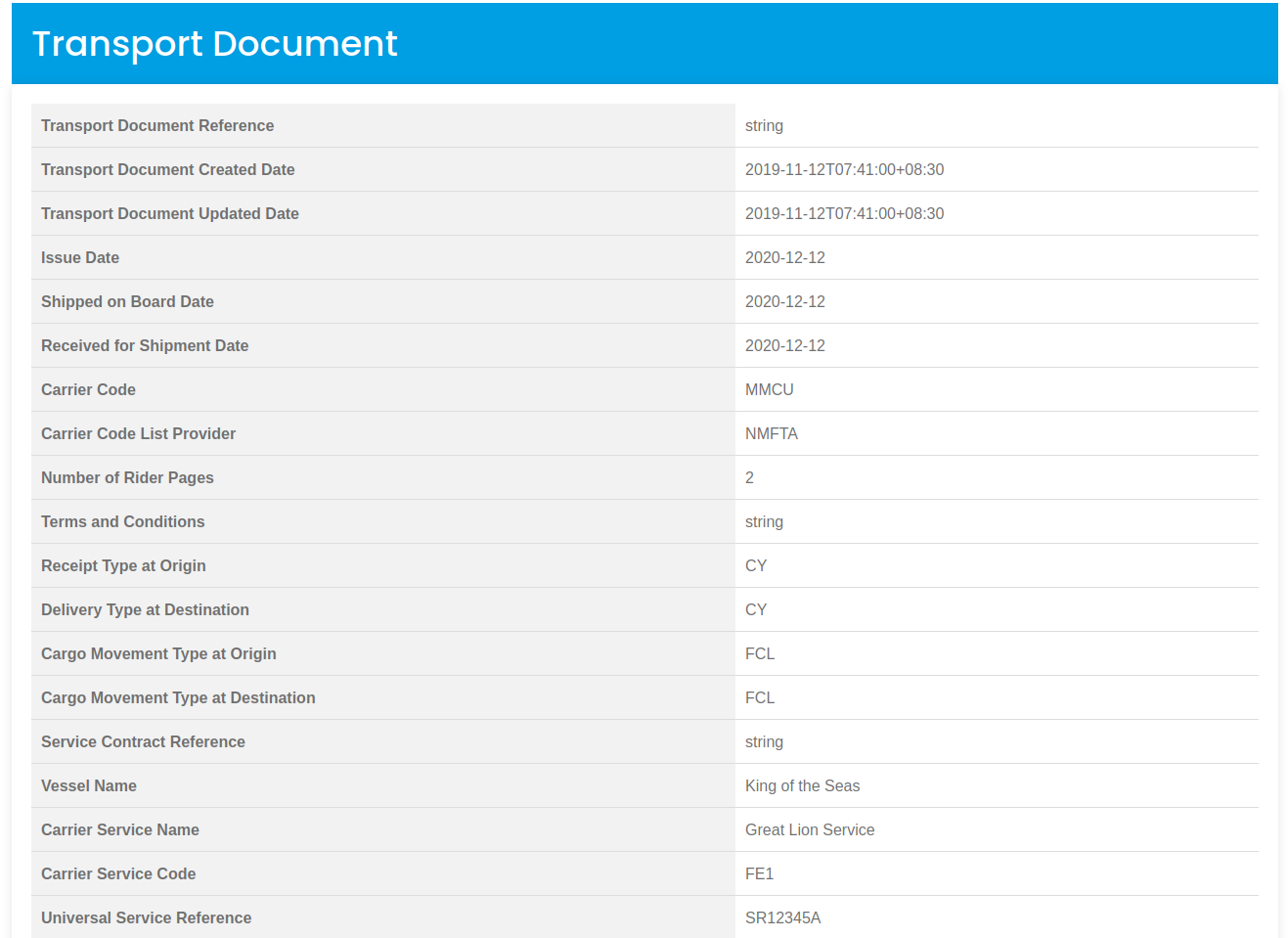

Verifying the transport document is a crucial step for the insurer to ensure that the goods are indeed shipped. This helps in preventing fraudulent claims and ensures that coverage is provided for legitimate shipments. Once the insurer confirms the authenticity of the transport document and satisfies themselves that the goods are en route, they issue the coverage policy to provide insurance protection for the cargo during transit. This policy typically outlines the terms, conditions, and coverage limits for the insured cargo, providing peace of mind for both the shipper and the recipient in case of any unforeseen events or damages during transportation.

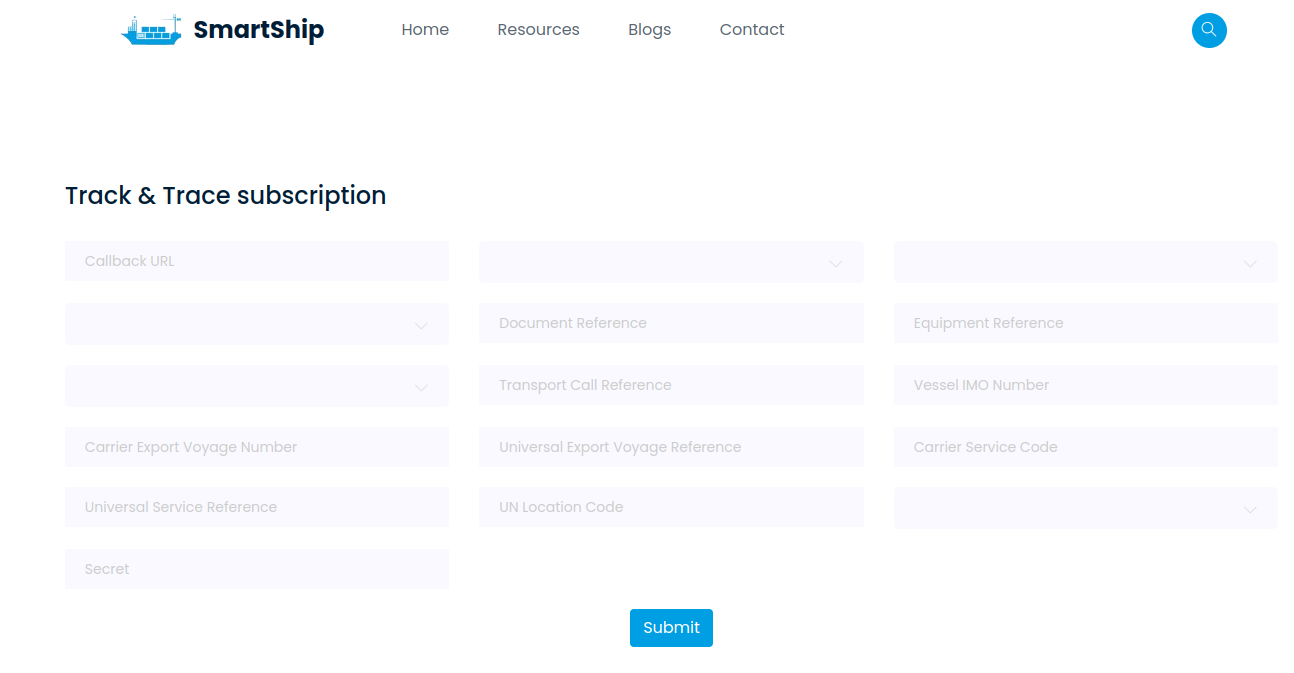

The shipper submits a track & trace subscription request to the carrier, seeking updates regarding the shipment, equipment, and transport events. This request enables the shipper to stay informed about the status and progress of the consignment throughout its journey.